Consumers Energy - Design Thinking + Service Blueprint

Consumers Energy

Uncovering needs for utility customers

Creating a service blueprint to address opportunities for a better customer experience and communication

Project Overview

Goal

Consumers Energy, a local Michigan utility company, needed to create a service blueprint that would understand the current utility experience while uncovering opportunities for future experiences that would better align the customer experience with needs. Secondarily, we would be asked to help Consumers Energy uncover attitudes, expectations, and potential impact of an implementation of a time-of-use (energy saving program) program.

Problem Statements

How might we discover and map the current utility experience to properly identify and address areas of opportunity?

How might we better communicate to our customers new energy saving programs and initiatives?

The Team

Days are for strategizing. Nights are for drinks and corn hole.

Project Responsibilities

Visual Design Lead on a bespoke team for this Accenture engagement. The team would collaborate on-site with our FJORD (now part of Accenture Song) partners and Consumers Energy stakeholders to strategize and implement a plan that included upfront research, identify gaps in our understanding, set up and conduct workshops, and create outputs of those sessions (blueprint).

Primary -

Ideate with the team on identifying personas based on the inputs (documentation, previous research, etc) available to us at the time and pull together their customer journeys

When gaps in the research were identified, I would travel with the team to participate at off-site locations to co-facilitate, observe, take notes, and empathize with actual Consumers Energy customers, and customer service representatives.

Leverage these outputs in our customer journeys and workshops with Consumers Energy stakeholders.

In parallel, we would meet as a team to discuss strategy for our workshops that would include an understanding of who to invite, where to place them, the itinerary/schedule, and the methods that we wanted to deploy in those sessions to uncover the insights that we would need for the blueprint

Design thinking methods that we would use…

Pre-work - homework (primer) for the workshops

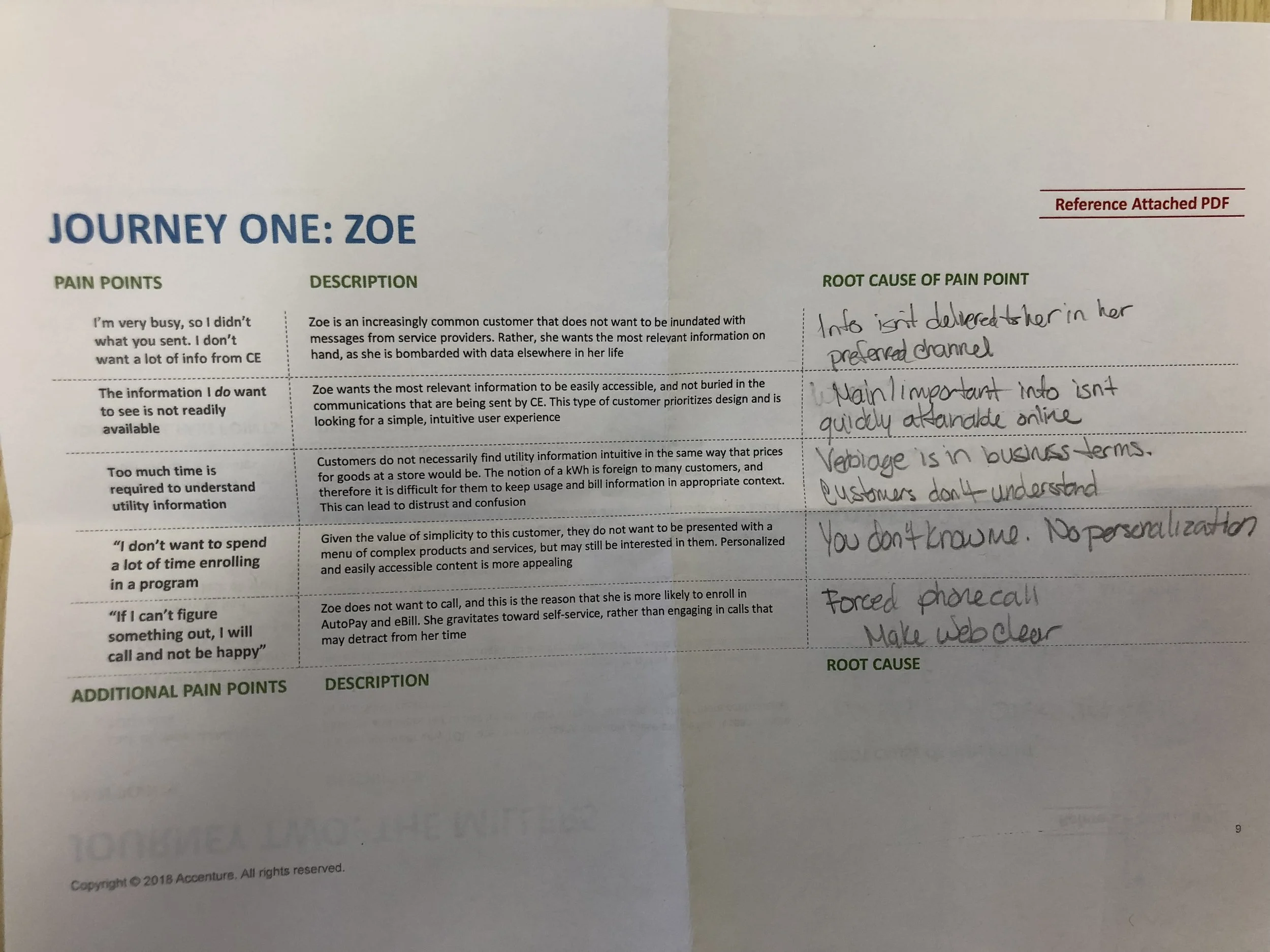

Customer journeys - we would spend time in the first session diving deep into each persona and call out pain points specific to their journeys

Empathy mapping - method that would help build an innate understanding of their customers

Round robin concepting - method that would ask our participants to come up with a concept based on their understanding of customer needs

Concept poster - method that would ask our participants (in groups) to go into greater detail for their solution

LOVE index - presentations of concepts would be graded by all participants on several qualitative metrics

Secondary -

Ensure we had all of the materials we needed to support our workshops

Present the various customer journeys for our planned design thinking workshops to our clients based on our learnings

Prepare the final service blueprint deliverable and, if possible, edit recordings of our focus group sessions to share with the Consumers Energy CEO (at the time it was Patty Poppe)

Planning and Strategy

Growing empathy for our clients with their customers would be pivotal for this work. To create that empathy, we would map customer journeys for several customer segments. For that we would pour over research, work with our stakeholders to identify any gaps in our knowledge, and begin to map who and what their goals were in interacting with Consumers Energy. Identified gaps would be supplemented, qualitatively, through focus groups, dscout diaries and CSR observations.

Focus Groups + Dscout Missions

Needing an innate understanding of the challenges that customers faced in understanding their utility bills and any upcoming changes at a programmatic level, we would sit in and collaborate with Consumers Energy (sharing our questions to be asked with the moderator) in speaking to their customers in focus groups throughout Michigan (Grand Rapids, Flint, Lansing) and, in parallel, run missions through dscout, a generative research platform, to gain first hand knowledge of utility customer experiences and expectations, as it related to energy saving programs, throughout the country.

This would help to fill any potential gaps in our research as well as provide quotable insights that we could then incorporate into our customer journeys.

To view the video in full detail: Consumers Energy Focus Group and Dscout Insights

As a part of this exercise, Consumers Energy wanted to understand the impact the change over to time-of-use rates would have on customers utility bills and what their responses would be. Below is an example of the visual that was shared out in our focus group sessions based on actual customer data (blurred for confidentiality) for those that participated in these sessions.

Example utility bill used in focus group sessions based on actual participant data.

Interestingly, when we showed the change in their bill, a great many of those customers that participated in the focus group sessions were pleasantly surprised that their bill would only increase, or in some cases decrease, by about $5-10. For customers that were already skeptical of the utility, transparency in communication and the relative accuracy of the increase/decrease in their bills proved effective in easing many concerns customers with the forthcoming switch over to time-of-use rates (higher rates during peak hour energy usage between 2-7pm in the summer months).

CSR (customer service representatives) Shadowing Session

While most of our upfront research would place more of an emphasis on focus groups and dscout missions for first-hand qualitative customer insights, we would also take the opportunity to spend a day and meet with Consumers Energy CSRs in Royal Oak, Michigan. In sitting with their CSRs as they took support calls, we could see how Consumers Energy support specialists would answer calls, use the information available to them, and provide solutions to their customers. What we heard in these support calls was revealing and shed even more importance on the aspect of greater communication…

How long will take for Consumers Energy to turn power back on after an outage?

Reports of downed trees and power lines, the time it would take to clear them, and who would be responsible for that work.

Questions on billing and the options available to them to pay them at once or on a payment plan.

Questions on several power saving usage programs and how to effectively save more money on their bills.

Greater clarity around the fluctuation of utility bills.

During an onsite Q/A session, several CSRs provided our team with additional anecdotal insights about Consumers Energy customers to provide context around the friction that they heard on their support calls, the frequency of those issues, and why it was continuing to happen. The insights proved invaluable in better understanding pain points with their customers service and building empathy around their needs.

Customer Journeys

Penny

The customer who monitors their electric bills closely and is acutely aware of month-to-month fluctuations.

Characteristics of this profile -

“I want to be informed; I need CE to communicate with me in advance.”

Heightened sensitivity to budget lends to higher expectations for timeliness and clarity in direct to consumer communications.

Communication should rely less on corporate specific language (ie. acronyms and terms specific to the industry) and more on language that is simple and relatable.

Trust is earned not given. Skepticism breeds mistrust when utility bills fluctuate.

Customer Journey Map - Education, Awareness & Engagement - Penny

Customer Journey Map - Billing & Payment Experience - Penny

Zoe

The digitally native customer they often “set it and forget it”. They expect experiences to “fit” into their busy schedule.

Characteristics of this profile -

“I try to solve issues (with the bill) on my own then, if I can’t figure it out, I would call.”

They are tech savvy, looking to the internet and the Consumers Energy site to find answers to their questions.

Their expectations are high for pro-active communications, preferring push notifications to traditional methods (example, email) for outreach.

They prefer to monitor their energy usage through native applications and websites that prioritize pro-active communications.

Customer Journey Map - Education, Awareness & Engagement - Zoe

Customer Journey Map - Billing & Payment - Zoe

The Millers

The vulnerable customer subset, they rely on the utility to support them in keeping their bills from fluctuating from month-to-month.

Characteristics of this profile -

“You need to communicate (your messaging) in large print on the bill or in a colorful graphic or else I won’t be able to see or notice it.”

They are less tech savvy, looking to the utility company to provide them guidance and ways to keep their bills consistent.

As they rely on retirement income as their only source of income, they prefer consistency in the amount of their monthly bills.

They prefer communicating with the utility company through traditional means (phone support) and rely on customer support to provide guidance and understanding.

Customer Journey Map - Education, Awareness and Engagement - The Millers

Customer Journey Map - Billing and Payment - The Millers

Albert

The engaged greens subset of customers are pro-active in seeking answers and know where to look to track their energy usage. They handle fluctuations in their bill better than most and seek to understand “the why”.

Characteristics of this profile -

“I would feel better if bill increase was subsidizing customers who cannot currently afford their energy bills.”

They know how to use the resources available to them through the website and apps.

They understand that fluctuations, in their utility bills, can happen from time to time but want a clear explanation as to why it is happening.

Their income is high enough to where these fluctuations don’t have a major impact on their living situation and because of this they prioritize the impact of where the energy is coming from with a preference towards renewable energy sources to lessen their carbon footprint on the environment and/or in helping others who need assistance in paying their energy bills.

Customer Journey Map - Education, Awareness and Engagement - Albert

Design Thinking Workshops

Having formed a complete picture of our customer segments, I would create the journeys that we would use in our design thinking workshops with Consumers Energy stakeholders to build empathy for their customers. We would devise a plan for the workshops that would take into consideration any pre-work necessary to prime them for the upcoming workshops, the participants that we would need to include, where they would sit, what customer segment they would be responsible for, and planned exercises for the workshops which would focus on the need, first, and then place the focus, once the empathy was built, for our groups on concepts that could potentially solve for their customers needs.

Pre-work

Priming our stakeholder participants for the design thinking workshops to come with an emphasis on building empathy. Stakeholder participants were asked to bring the pre-work packet into the workshops with them.

Building empathy for your customer segment

For this exercise, we instructed our groups of stakeholders to review as a group their assigned customer segment, take careful note of their customers needs, and points of friction. Once complete, we supplied each group with red dots to vote on the most pressing needs for their segment and then bucket them into themes that would provide the basis for their conceptual solutions.

Empathy mapping

The empathy mapping exercise focused on critical understanding of the previous exercise and gaining a greater appreciation of the user segment with a focus on…

Task completion - what tasks is the user trying to complete and what questions might they have?

Influences - what people or experiences are impacting their decisions?

Goals - what are they trying to achieve?

Pain points - what friction might they be experiencing?

Feelings - with respect to the experience, what is the user feeling and what matters to them most?

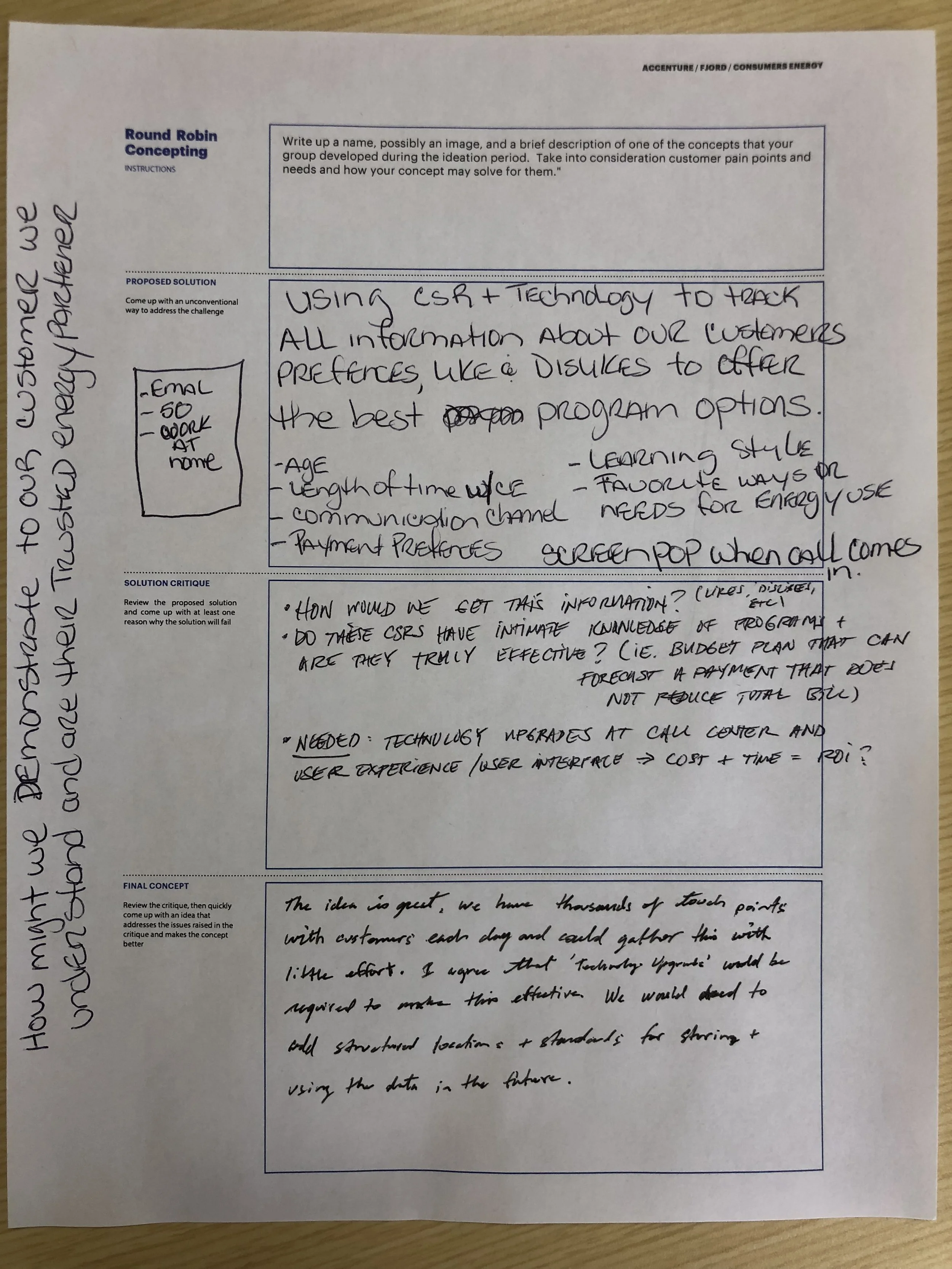

Round Robin Concepting

This exercise would ask each participant in all of our groups to formulate a conceptual solution based on what was discovered in the ideation portion of the workshop. We would time (set at about 15 mins) each stakeholder in providing the idea with summaries and sketches. Once complete, we would ask them to slide the page to their left/right to have another member of their group provide a critique, primarily from a technical feasibility perspective, and finally, after the last switch, a finalized concept with the learnings above.

Once complete we asked each group to vote on their favorite solution to take forward.

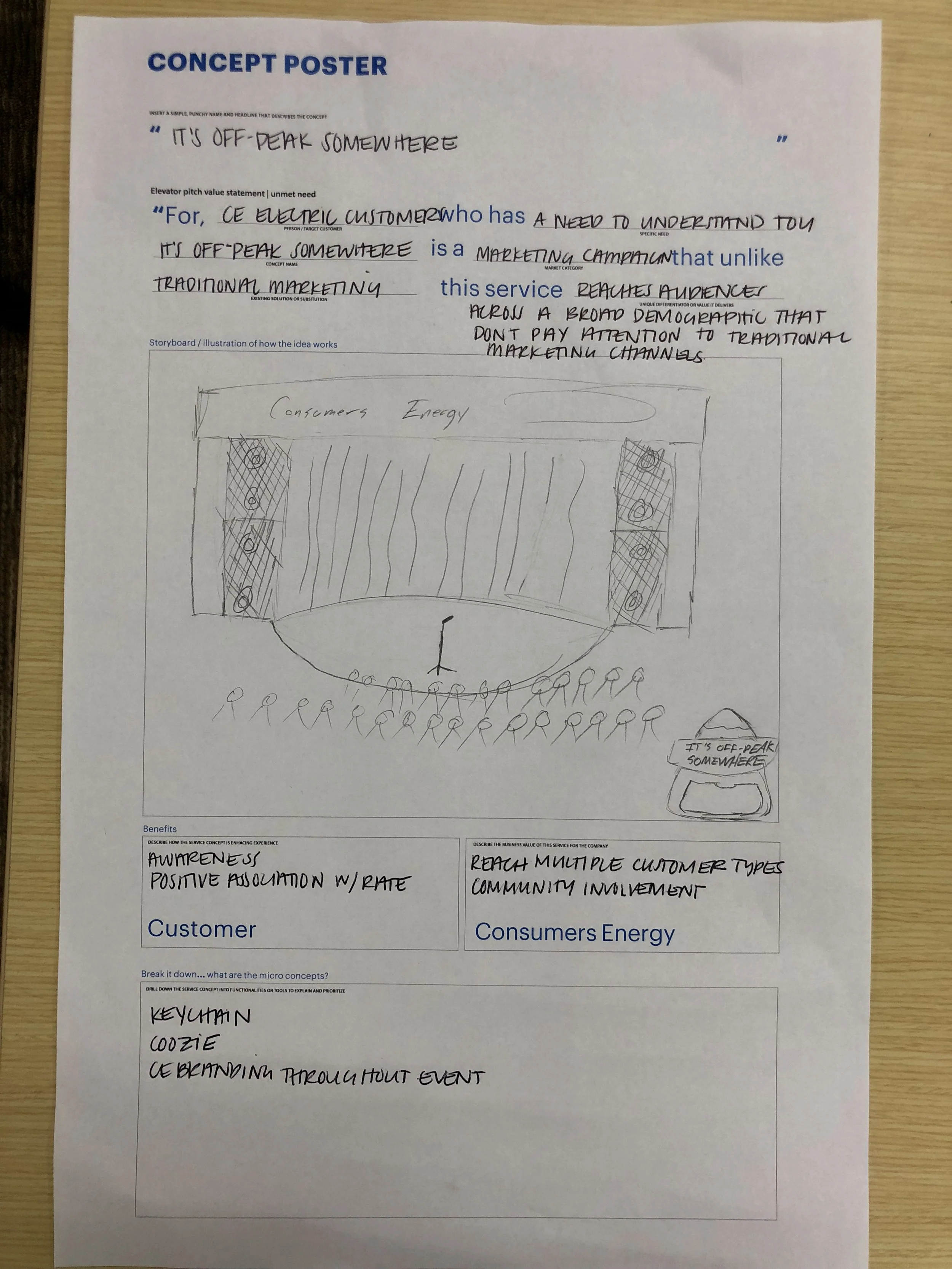

Concept Poster

As concepts materialized, we asked participants to begin visualizing the solution using the concept poster, starting with a tagline and an elevator pitch. A section dedicated to “benefits” would outline the benefits for customers and the business (Consumers Energy). When finished each group would choose a representative to present the idea to the rest of the participants.

LOVE Index

The LOVE index would lean into this idea of what makes user love a brand, product, service or experience based on the following levels…

Authenticity - the brand/product/service/experience conveys a distinct personality and stay true to self

Fun - the brand/product/service/experience holds people’s attention in an entertaining way

Relevant - the brand/product/service/experience creates relevant consumer touchpoints

Engaging - the brand/product/service/experience identifies with individual needs and wants

Social - the brand/product/service/experience connects people with each other

Helpful - the brand/product/service/experience is intuitive, clear, and easy to understand

In grading each solution against these metrics, stakeholders could show their support for each concept being represented. We would tally the votes during synthesis and share the results in our final readout and deliverable with Consumers Energy leadership.

Final Deliverable

Using the phases of our journeys as a template, I pulled in concepts from our workshops with stakeholders that attempted to solve for the pain points each customer segment was experiencing given the phase of their respective journeys. Focus areas attempted to bring to light areas of important customer need as mapped against the phase in the journey. Our recommendations would follow this same mapping to suggest solutions to these areas of customer need as well as recommend the business unit that would need to take the lead or collaborate with other departments in implementing the recommended strategy.

Service Blueprint - Education, Awareness and Engagement for the Future State Experience

Service Blueprint - Billing and Payments for the Future State Experience